Group VAT settlement allows companies that are linked through control relationships and meet certain regulatory requirements to perform a single, consolidated VAT settlement for the entire group. This is done by offsetting the VAT credits and debits arising from the periodic settlements of each participating company, which transfer their balances to the group parent company.

As a result, both the periodic payments and the year-end adjustment are handled by the parent company, which calculates the total VAT debit or credit.

Group VAT management is part of a broader set of topics to handle within the ERP system when managing multiple companies belonging to the same corporate group, typically including intercompany management and consolidated financial statements.

Our Fiscal Group app provides dedicated functionalities for Group VAT management in Business Central, including:

- Calculation of VAT settlements for the subsidiaries, with automatic transfer of balances to the parent company.

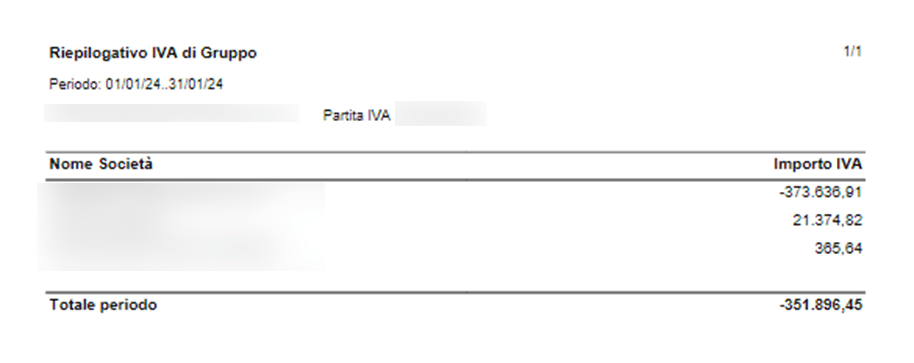

- Calculation of the VAT settlement for the parent company, including the balances from all subsidiaries.

- Dedicated reporting for Group VAT overview.

- Export of the LIPE (periodic VAT communication) with Group VAT details included.

The full documentation for the Fiscal Group app is available on the dedicated Memento Documentation Portal.

Contact us for more information!