Proper management of customer credit helps reduce risks and improve the company’s cash flow.

Business Central allows you to specify a credit limit for each customer directly on their customer card.

When entering sales orders, if the customer’s credit exceeds the assigned limit, a non-blocking alert message is displayed. This message is informational, and it is still possible to proceed with releasing the order.

The utilized credit is calculated as:

Balance + Outstanding Orders + Uninvoiced Shipments – Outstanding Returns – Uninvoiced Return Receipts – Prepayment Amounts on Sales Orders.

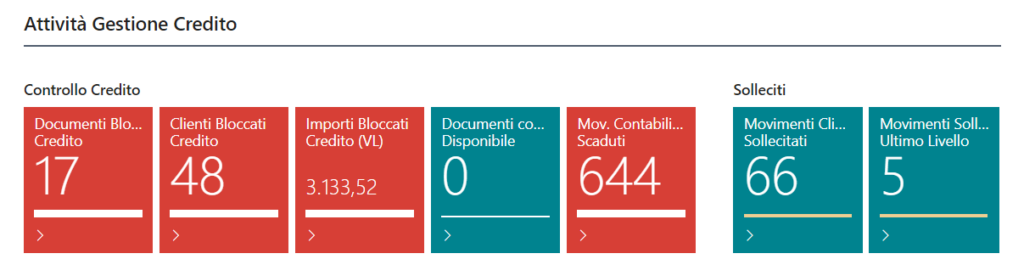

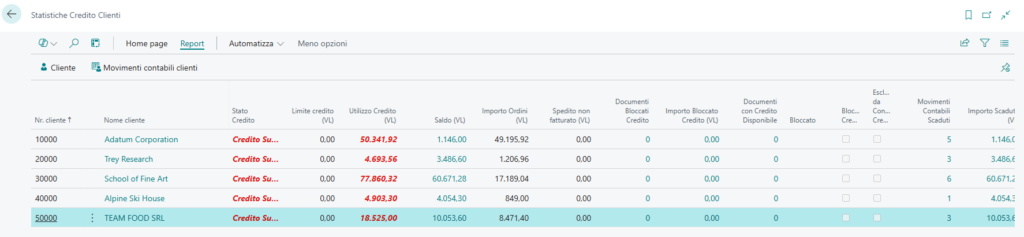

In addition to the standard functionalities, our Credit Management app offers enhanced credit control features.

Specifically, it allows for the activation of document blocks for customers who have exceeded their credit limit. This ensures that documents cannot be released or processed until they have been explicitly approved.

Authorized users can quickly view the documents and customers requiring verification and proceed to unblock the credit status if necessary.

The statistics dashboards allow you to quickly monitor key business indicators, including the ability to calculate the average payment days and delays per customer.

The complete documentation for the Credit Management app is available on the dedicated Memento documentation portal.